When it comes to planning for retirement, Social Security benefits play a crucial role in ensuring financial stability. For many, understanding the intricacies of Social Security can be overwhelming. That's where the AARP Social Security Calculator comes into play. This tool is designed to help you estimate your benefits and strategize your retirement planning effectively. By leveraging this calculator, you can make informed decisions about when to claim your benefits to optimize your retirement income.

In today's rapidly changing economic landscape, having a reliable source of income during retirement is more important than ever. The AARP Social Security Calculator offers a user-friendly way to explore different scenarios and determine the best course of action for your unique financial situation. Whether you're nearing retirement age or planning for the future, this calculator provides valuable insights into your Social Security benefits, helping you make the most of your hard-earned contributions.

Utilizing the AARP Social Security Calculator can be a game-changer for those seeking to maximize their retirement benefits. With its straightforward interface and comprehensive calculations, you can explore various claiming strategies and understand how factors like age, work history, and marital status can impact your benefits. This tool empowers you to take control of your financial future and make decisions that align with your retirement goals.

Read also:Empowered Assurance No Weapon Formed Against Shall Prosper

Table of Contents

- What is the AARP Social Security Calculator?

- How Does the AARP Social Security Calculator Work?

- Benefits of Using the AARP Social Security Calculator

- Who Can Benefit from the AARP Social Security Calculator?

- How to Access the AARP Social Security Calculator

- Understanding Social Security Benefits

- How Can You Maximize Your Social Security Benefits?

- Impact of Retirement Age on Benefits

- How Marital Status Affects Social Security Benefits?

- Importance of Early Retirement Planning

- Common Mistakes to Avoid with Social Security

- Frequently Asked Questions

- Conclusion

What is the AARP Social Security Calculator?

The AARP Social Security Calculator is an online tool developed by the American Association of Retired Persons (AARP) to assist individuals in estimating their Social Security benefits. This calculator provides a personalized approach to understanding potential benefits based on your work history, age, and other factors. With its easy-to-use interface, you can input various parameters to explore different retirement scenarios and make informed decisions about your Social Security claims.

The primary purpose of this calculator is to offer insight into how different claiming strategies can affect your overall benefits. By simulating various scenarios, you can plan your retirement more effectively, ensuring that you maximize your Social Security income. Whether you're considering retiring early or delaying your benefits, the AARP Social Security Calculator provides valuable guidance tailored to your individual circumstances.

Moreover, the tool offers educational resources and tips to help users understand the complexities of Social Security. By using the AARP Social Security Calculator, you can gain a deeper understanding of how your choices impact your financial future, making it an indispensable resource for anyone planning for retirement.

How Does the AARP Social Security Calculator Work?

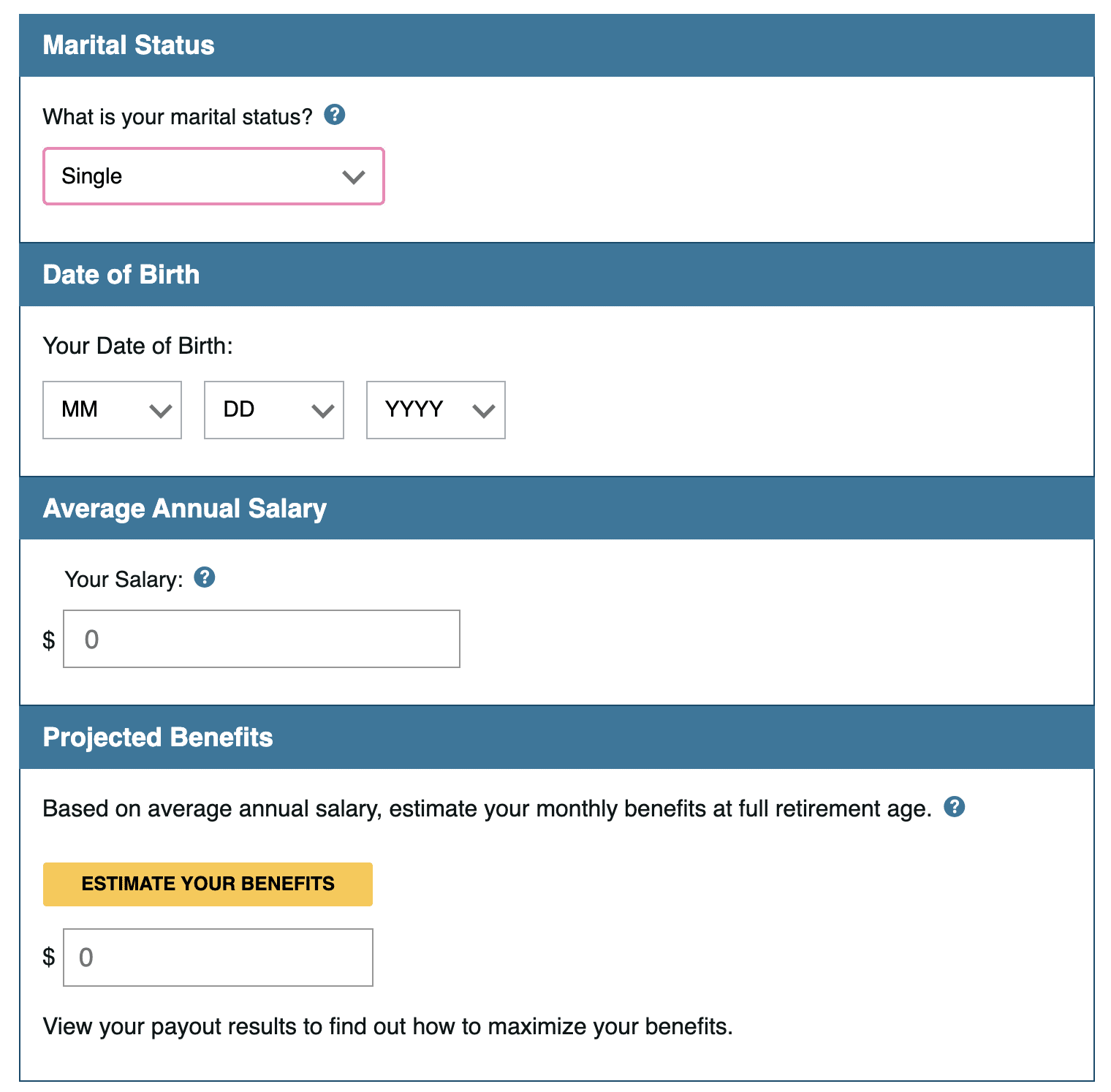

The AARP Social Security Calculator operates by allowing users to input essential information such as birth date, expected retirement age, and average annual income. Based on this data, the calculator estimates your monthly Social Security benefits. It considers factors like the age at which you start claiming benefits, your work history, and any additional income you might have.

When you enter your details, the calculator uses algorithms to project your future benefits. It provides a range of scenarios, showcasing how different claiming ages can impact your monthly and lifetime benefits. This feature is particularly valuable for those unsure about the best time to begin receiving Social Security payments.

Additionally, the calculator offers insights into the effects of working longer or retiring earlier, allowing you to adjust your plans accordingly. By experimenting with different inputs, you can visualize the financial outcomes of various retirement strategies, empowering you to make informed decisions aligned with your long-term goals.

Read also:The Untold Story Of Danny White Cowboys A Football Icon

Benefits of Using the AARP Social Security Calculator

There are numerous advantages to utilizing the AARP Social Security Calculator. Firstly, it provides a clear and concise estimation of your potential benefits, helping you plan your retirement with confidence. By understanding your expected income, you can make informed decisions about other retirement savings and investments, ensuring a well-rounded financial plan.

Secondly, the calculator allows you to explore multiple claiming strategies, offering insights into how different choices can impact your benefits. This knowledge is crucial for optimizing your Social Security income, especially for those with unique financial needs or circumstances. By using the calculator, you can identify the strategy that best suits your retirement goals, whether it's retiring early, working longer, or coordinating benefits with a spouse.

Furthermore, the AARP Social Security Calculator is a free resource available to anyone interested in planning for retirement. Its user-friendly interface and comprehensive calculations make it accessible to individuals of all technological backgrounds, ensuring that everyone can benefit from its insights.

Who Can Benefit from the AARP Social Security Calculator?

The AARP Social Security Calculator is a valuable tool for anyone planning for retirement, regardless of age or income level. It is particularly beneficial for individuals approaching retirement age who need a clear understanding of their Social Security benefits. By providing personalized estimates, the calculator helps users make informed decisions about when to start claiming benefits, ensuring they maximize their retirement income.

Moreover, younger individuals can also benefit from using the calculator as part of their long-term financial planning. By exploring potential benefits early on, they can make strategic decisions about career paths, savings, and investments to ensure a secure financial future.

Additionally, the calculator is useful for financial advisors and planners who wish to provide clients with accurate and personalized Social Security benefit estimates. By incorporating this tool into their planning process, advisors can offer more comprehensive advice and strategies to help clients achieve their retirement goals.

How to Access the AARP Social Security Calculator

Accessing the AARP Social Security Calculator is simple and straightforward. To get started, visit the AARP website and navigate to the Social Security section. From there, you can find the calculator tool, which is available for free to all users.

Once on the calculator page, you'll be prompted to enter your personal information, such as your birth date, expected retirement age, and average annual income. After inputting this data, the calculator will generate an estimate of your Social Security benefits based on the information provided.

The tool is designed to be user-friendly, with clear instructions and prompts to guide you through the process. If you encounter any issues or have questions, AARP offers additional resources and support to assist you in understanding and using the calculator effectively.

Understanding Social Security Benefits

Social Security benefits are a vital source of income for retirees in the United States. These benefits are designed to provide financial support to individuals who have contributed to the Social Security system through payroll taxes during their working years. Understanding how these benefits are calculated and what factors influence them is essential for effective retirement planning.

The amount of Social Security benefits you receive is determined by several factors, including your average indexed monthly earnings (AIME), your primary insurance amount (PIA), and the age at which you begin claiming benefits. Your AIME is calculated based on your highest-earning years, while your PIA is determined by a formula that considers your AIME and other factors.

It's important to note that the age at which you start claiming benefits can significantly impact your monthly payments. If you claim benefits before your full retirement age (FRA), your monthly payments will be reduced. Conversely, delaying benefits past your FRA can result in increased monthly payments due to delayed retirement credits.

How Can You Maximize Your Social Security Benefits?

Maximizing your Social Security benefits requires careful planning and consideration of various factors. One of the most effective strategies is to delay claiming benefits until you reach your full retirement age or even later. By doing so, you can take advantage of delayed retirement credits, which increase your monthly payments for each year you delay claiming benefits beyond your FRA.

Another strategy is to coordinate benefits with your spouse, if applicable. Married couples have the option to claim spousal benefits, which can provide additional income. By strategically timing when each spouse claims benefits, you can maximize the total household benefits received over your lifetime.

It's also important to consider your work history and earnings. Ensuring that you have at least 35 years of earnings recorded will help maximize your AIME, as Social Security calculates benefits based on your highest 35 years of earnings. If you have fewer than 35 years of earnings, zeros will be factored into the calculation, potentially reducing your benefits.

Impact of Retirement Age on Benefits

The age at which you choose to retire and start claiming Social Security benefits can have a significant impact on the amount you receive. Understanding how different retirement ages affect your benefits is crucial for making informed decisions about when to claim.

If you choose to claim benefits before reaching your full retirement age, your monthly payments will be reduced. The reduction is based on the number of months you claim before your FRA, with a maximum reduction of 30% if you claim at age 62. This reduction is permanent and will affect your benefits for the rest of your life.

On the other hand, delaying benefits beyond your FRA results in increased monthly payments due to delayed retirement credits. For each year you delay claiming benefits past your FRA, your monthly payments increase by approximately 8%. This increase continues until you reach age 70, providing a significant boost to your lifetime benefits.

How Marital Status Affects Social Security Benefits?

Marital status plays a crucial role in determining Social Security benefits, particularly for married couples. Understanding how your marital status affects your benefits can help you make strategic decisions about retirement planning.

Married individuals have the option to claim spousal benefits, which can provide additional income. Spousal benefits allow you to receive up to 50% of your spouse's primary insurance amount (PIA) if you are at least full retirement age. This can be advantageous if your own benefits are lower than your spouse's.

Divorced individuals may also be eligible for spousal benefits based on their ex-spouse's work record, provided they were married for at least 10 years. Remarriage can affect eligibility for spousal benefits, so it's important to understand the rules and regulations surrounding these benefits.

Importance of Early Retirement Planning

Early retirement planning is essential for ensuring a secure and comfortable retirement. By starting the planning process early, you can make strategic decisions about savings, investments, and Social Security benefits that align with your long-term goals.

One of the key benefits of early retirement planning is the ability to take advantage of compound interest. By consistently contributing to retirement accounts like 401(k)s or IRAs, you can grow your savings over time, providing a substantial financial cushion during retirement.

Additionally, early planning allows you to explore different retirement scenarios and make informed decisions about when to claim Social Security benefits. By using tools like the AARP Social Security Calculator, you can visualize the financial impact of various claiming strategies and choose the one that maximizes your benefits.

Common Mistakes to Avoid with Social Security

When it comes to Social Security, there are several common mistakes that individuals should avoid to ensure they receive the maximum benefits possible. Being aware of these pitfalls can help you make informed decisions and avoid costly errors.

One common mistake is claiming benefits too early. While it may be tempting to start receiving payments as soon as possible, doing so can result in a permanent reduction in monthly benefits. Carefully consider your financial situation and retirement goals before deciding when to claim.

Another mistake is not coordinating benefits with a spouse. Married couples can optimize their benefits by strategically timing when each spouse claims benefits. Failing to do so can result in lower overall household income during retirement.

Frequently Asked Questions

1. What is the AARP Social Security Calculator?

The AARP Social Security Calculator is an online tool designed to help individuals estimate their Social Security benefits based on their work history, age, and other factors. It provides personalized insights into potential benefits and claiming strategies.

2. How does the AARP Social Security Calculator work?

The calculator operates by allowing users to input essential information such as birth date, expected retirement age, and average annual income. It then estimates your monthly benefits based on this data and offers scenarios to explore different claiming strategies.

3. Can the AARP Social Security Calculator help me maximize my benefits?

Yes, the calculator provides valuable insights into how different claiming strategies can impact your benefits. By experimenting with various scenarios, you can make informed decisions to optimize your Social Security income.

4. Who can benefit from using the AARP Social Security Calculator?

Anyone planning for retirement can benefit from using the calculator. It is particularly useful for individuals nearing retirement age who need a clear understanding of their Social Security benefits and potential claiming strategies.

5. How can I access the AARP Social Security Calculator?

You can access the calculator by visiting the AARP website and navigating to the Social Security section. The tool is free to use and provides valuable insights into your retirement planning.

6. What are common mistakes to avoid with Social Security?

Common mistakes include claiming benefits too early, not coordinating benefits with a spouse, and failing to understand how retirement age affects benefits. Avoiding these pitfalls can help you maximize your Social Security income.

Conclusion

The AARP Social Security Calculator is an invaluable resource for anyone planning for retirement. By providing personalized estimates and insights into various claiming strategies, the calculator empowers individuals to make informed decisions about their Social Security benefits. Whether you're nearing retirement age or planning for the future, utilizing this tool can help you maximize your retirement income and achieve your long-term financial goals. Start using the AARP Social Security Calculator today to take control of your financial future and ensure a secure and comfortable retirement.