The importance of mobile banking cannot be overstated, especially in a society where digital transactions are becoming the norm. The TD Bank App not only offers standard banking services but also introduces innovative features that enhance the overall banking experience. Whether it's checking your account balance, transferring funds, or paying bills, the TD Bank App ensures that you have everything you need at your fingertips. Furthermore, the app's commitment to security means you can manage your finances with peace of mind, knowing your personal information is well-protected. As we delve into the functionalities and benefits of the TD Bank App, this article will provide an in-depth exploration of its features, usability, and the advantages it brings to users. From understanding how to set up and navigate the app to exploring its unique offerings, we aim to equip you with the knowledge needed to maximize your financial management using the TD Bank App. Let's embark on this journey to uncover the full potential of mobile banking with TD Bank.

1. What is the TD Bank App? 1.1 Overview of TD Bank 1.2 Introduction to the TD Bank App 2. How to Download and Install the TD Bank App? 2.1 Compatible Devices 2.2 Step-by-Step Installation Guide 3. Setting Up Your Account on the TD Bank App 3.1 Creating a New Account 3.2 Linking Existing Accounts 4. What Features Does the TD Bank App Offer? 4.1 Account Management 4.2 Transaction Capabilities 5. Is the TD Bank App Secure? 5.1 Security Measures Implemented 5.2 User Guidelines for Enhanced Security 6. Can You Pay Bills Using the TD Bank App? 6.1 Steps to Pay Bills 6.2 Managing Recurring Payments 7. How to Transfer Money with the TD Bank App? 7.1 Internal Transfers 7.2 External Transfers 8. Managing Your Debit and Credit Cards 8.1 Activating and Deactivating Cards 8.2 Monitoring Card Transactions 9. Exploring Investment Opportunities within the TD Bank App 9.1 Investment Account Setup 9.2 Tracking Your Investments 10. How Does the TD Bank App Compare to Other Banking Apps? 10.1 Key Differences 10.2 User Reviews and Ratings 11. How to Troubleshoot Common Issues in the TD Bank App? 11.1 Common Problems and Solutions 11.2 Customer Support Options 12. Benefits of Using the TD Bank App for Small Businesses 12.1 Business Account Features 12.2 Integrating Business Tools 13. Understanding the TD Bank App's Notification System 13.1 Customizing Alerts 13.2 Staying Informed About Account Activity 14. How to Utilize the TD Bank App for Budgeting? 14.1 Budgeting Tools Available 14.2 Analyzing Spending Habits 15. FAQs About the TD Bank App 15.1 Can I access the TD Bank App internationally? 15.2 How do I reset my TD Bank App password? 15.3 What should I do if the TD Bank App crashes? 15.4 Are there any fees for using the TD Bank App? 15.5 How do I update the TD Bank App? 15.6 Can I customize the TD Bank App interface? What is the TD Bank App?

The TD Bank App is a comprehensive mobile banking solution developed by TD Bank to provide customers with convenient access to their financial services. As one of North America's largest banks, TD Bank has built a reputation for its customer-focused approach and innovative banking solutions. The TD Bank App is an extension of this commitment, offering a platform where users can manage their accounts, perform transactions, and access a variety of financial tools from the convenience of their smartphone or tablet.

Read also: Khal Drigo The Charismatic Leader And His Enduring Influence

Overview of TD Bank

TD Bank, also known as Toronto-Dominion Bank, is a Canadian multinational banking and financial services corporation headquartered in Toronto, Ontario. Established in 1955 through the merger of the Bank of Toronto and the Dominion Bank, TD Bank has grown to become one of the largest banks in North America. It offers a wide range of financial products and services, including personal and commercial banking, wealth management, insurance, and more. With a strong presence in both Canada and the United States, TD Bank is committed to delivering exceptional customer service and innovative banking solutions.

Introduction to the TD Bank App

The TD Bank App was created to meet the growing demand for mobile banking solutions. It provides users with the ability to manage their accounts, perform transactions, and access a variety of banking services directly from their mobile devices. The app's intuitive design and user-friendly interface make it easy for customers to navigate and find the information they need. Additionally, the TD Bank App offers a range of features that enhance the banking experience, such as mobile check deposit, bill pay, and real-time alerts.

How to Download and Install the TD Bank App?

Downloading and installing the TD Bank App is a straightforward process that ensures you have access to your banking services on the go. Whether you're an Android or iOS user, the app is readily available for download from the Google Play Store and the Apple App Store. Here's a step-by-step guide to help you get started.

Read also: Intriguing Lives And Careers Dana Bash And John King

Compatible Devices

The TD Bank App is compatible with a wide range of devices to accommodate various user preferences. The app supports:

- iOS devices: iPhones and iPads running iOS 12.0 or later.

- Android devices: Smartphones and tablets running Android 7.0 (Nougat) or later.

Ensure your device meets these requirements to enjoy a seamless experience with the TD Bank App.

Step-by-Step Installation Guide

- Access the App Store: Open the Google Play Store on your Android device or the Apple App Store on your iOS device.

- Search for the TD Bank App: Use the search bar to find the "TD Bank App" and select the official app from the search results.

- Download the App: Tap the "Install" button on Android or the "Get" button on iOS to begin downloading the app to your device.

- Open the App: Once the download is complete, tap "Open" to launch the TD Bank App.

- Log in or Sign up: If you already have a TD Bank account, log in using your credentials. If you're a new user, follow the on-screen instructions to create an account.

With these simple steps, you can download and install the TD Bank App, giving you the freedom to manage your finances from anywhere.

Setting Up Your Account on the TD Bank App

Once you've downloaded and installed the TD Bank App, the next step is to set up your account for personalized access to your banking services. The app provides a seamless process for both new and existing customers to get started quickly and efficiently.

Creating a New Account

If you're new to TD Bank, creating an account through the TD Bank App is a simple and convenient process. Here's how you can get started:

- Open the TD Bank App: Launch the app on your device and select the "Sign Up" option.

- Provide Personal Information: Enter your personal details, including your name, address, email, and phone number.

- Verify Your Identity: Follow the on-screen instructions to verify your identity. This may involve answering security questions or providing additional documentation.

- Create Login Credentials: Set up a username and password for secure access to your account.

- Complete the Registration: Review your information and submit your application to complete the account setup process.

Once your account is created, you can immediately start using the TD Bank App to manage your finances.

Linking Existing Accounts

If you're an existing TD Bank customer, linking your accounts to the TD Bank App is a straightforward process. Here's how you can do it:

- Log in to the TD Bank App: Enter your existing TD Bank online banking credentials to access the app.

- Link Your Accounts: Once logged in, navigate to the "Accounts" section and select the option to link your accounts.

- Follow the Prompts: Follow the on-screen instructions to link your TD Bank accounts to the app. You may need to verify your identity during this process.

After linking your accounts, you'll have access to all your TD Bank services directly from the app, making it easy to manage your finances on the go.

What Features Does the TD Bank App Offer?

The TD Bank App is packed with features that cater to the diverse needs of its users. From basic account management to advanced financial tools, the app provides a comprehensive suite of services designed to enhance your banking experience.

Account Management

Managing your accounts has never been easier with the TD Bank App. The app allows you to:

- View Account Balances: Check your account balances in real-time to stay informed about your financial status.

- Monitor Transactions: Keep track of your spending with a detailed transaction history that categorizes your expenses for easier analysis.

- Set Up Alerts: Customize alerts for account activity, such as low balance warnings or transaction notifications, to stay updated on any changes.

Transaction Capabilities

The TD Bank App streamlines your day-to-day banking activities with its transaction capabilities, which include:

- Money Transfers: Easily transfer funds between your accounts or send money to other TD Bank customers with just a few taps.

- Bill Payments: Pay your bills directly from the app, whether it's a one-time payment or a recurring transaction.

- Mobile Check Deposit: Deposit checks from anywhere by simply taking a photo of the check and submitting it through the app.

With these features, the TD Bank App empowers you to manage your finances efficiently and conveniently.

Is the TD Bank App Secure?

Security is a top priority for TD Bank, and the TD Bank App is equipped with advanced security measures to ensure the protection of your personal and financial information. The app employs a multi-layered approach to security, providing users with peace of mind as they manage their finances.

Security Measures Implemented

The TD Bank App incorporates several security features to safeguard your data, including:

- Encryption: All data transmitted between your device and the TD Bank servers is encrypted to prevent unauthorized access.

- Biometric Authentication: Use fingerprint or facial recognition to securely log in to the app, adding an extra layer of protection.

- Two-Factor Authentication: Enhance your account security by enabling two-factor authentication, which requires a second form of verification during login.

User Guidelines for Enhanced Security

While the TD Bank App is designed with robust security features, users can also take additional steps to protect their accounts:

- Strong Passwords: Create a strong and unique password for your TD Bank App account, avoiding easily guessable information.

- Regular Updates: Keep the app updated to the latest version to benefit from security patches and improvements.

- Monitor Account Activity: Regularly review your account transactions and report any suspicious activity immediately.

By following these guidelines, you can enhance the security of your TD Bank App account and enjoy a worry-free banking experience.

Can You Pay Bills Using the TD Bank App?

Paying bills has never been easier, thanks to the TD Bank App's convenient bill payment feature. Whether you're at home or on the go, the app allows you to manage your bill payments efficiently, ensuring you never miss a due date.

Steps to Pay Bills

Here's how you can pay bills using the TD Bank App:

- Log in to the App: Open the TD Bank App and log in using your credentials.

- Navigate to the Bill Pay Section: Access the "Bill Pay" feature from the app's main menu.

- Add Payees: Add the payees you wish to pay by entering their details, such as account numbers and billing addresses.

- Select the Payment Amount and Date: Choose the amount you wish to pay and select the payment date.

- Confirm the Payment: Review the payment details and confirm the transaction to complete the bill payment process.

With these simple steps, you can manage your bill payments effortlessly through the TD Bank App.

Managing Recurring Payments

The TD Bank App also offers the option to set up and manage recurring payments for your bills. This feature is particularly useful for bills that remain constant each month, such as rent or subscriptions. Here's how you can set up recurring payments:

- Access the Recurring Payments Option: Within the "Bill Pay" section, find the option to set up recurring payments.

- Specify Payment Details: Enter the payment amount, frequency (e.g., weekly, monthly), and start date for the recurring payment.

- Confirm the Setup: Review the recurring payment details and confirm the setup to activate the recurring payment.

By setting up recurring payments, you can automate your bill payments and eliminate the hassle of remembering due dates.

How to Transfer Money with the TD Bank App?

Transferring money with the TD Bank App is simple and convenient, allowing you to move funds quickly and easily between accounts or to other individuals. The app offers both internal and external transfer options to meet your financial needs.

Internal Transfers

Internal transfers refer to moving money between your own TD Bank accounts. Here's how you can perform an internal transfer using the app:

- Log in to the App: Access the TD Bank App and log in using your credentials.

- Navigate to the Transfers Section: Select the "Transfers" option from the main menu.

- Select Accounts: Choose the account you want to transfer money from and the account you want to transfer money to.

- Enter Transfer Details: Specify the transfer amount and any additional notes.

- Confirm the Transfer: Review the transfer details and confirm the transaction to complete the internal transfer.

Internal transfers are typically processed instantly, giving you immediate access to your transferred funds.

External Transfers

External transfers allow you to send money to accounts outside of TD Bank. Here's how you can initiate an external transfer:

- Log in to the App: Open the TD Bank App and log in using your credentials.

- Access the External Transfers Section: Navigate to the "Transfers" menu and select "External Transfers."

- Add Recipient Details: Enter the recipient's banking information, such as account number and routing number.

- Enter Transfer Amount: Specify the amount you wish to transfer.

- Confirm the Transfer: Review the transfer details and confirm the transaction to initiate the external transfer.

External transfers may take a few business days to process, depending on the recipient's bank policies.

Managing Your Debit and Credit Cards

The TD Bank App provides comprehensive tools to manage your debit and credit cards efficiently. From activating new cards to monitoring transactions, the app ensures you have full control over your card activities.

Activating and Deactivating Cards

Here's how you can activate or deactivate your cards using the TD Bank App:

- Log in to the App: Access the TD Bank App and log in using your credentials.

- Go to the Card Services Section: Navigate to the "Card Services" menu.

- Activate or Deactivate: Select the card you wish to activate or deactivate and follow the on-screen prompts.

Activating or deactivating your card is quick and easy, providing you with peace of mind if you lose your card or suspect unauthorized use.

Monitoring Card Transactions

Stay informed about your card activities by monitoring transactions in real-time through the TD Bank App. Here's how:

- Access the Card Transactions Section: Within the app, navigate to the "Card Transactions" menu.

- View Recent Transactions: Review recent transactions to ensure all charges are accurate.

- Set Up Alerts: Customize alerts for card activity to receive notifications about new transactions.

By regularly monitoring your card transactions, you can quickly identify any unauthorized charges and take appropriate action.

Exploring Investment Opportunities within the TD Bank App

Beyond everyday banking, the TD Bank App also offers features for those interested in exploring investment opportunities. Whether you're a seasoned investor or just starting, the app provides tools to help you manage and track your investments.

Investment Account Setup

Setting up an investment account through the TD Bank App is a simple process. Here's how you can get started:

- Log in to the App: Access the TD Bank App and log in using your credentials.

- Navigate to the Investments Section: Select the "Investments" option from the main menu.

- Open an Investment Account: Follow the on-screen instructions to open a new investment account.

- Choose Investment Options: Select the types of investments you're interested in, such as stocks, bonds, or mutual funds.

Once your investment account is set up, you can start building and managing your portfolio directly from the app.

Tracking Your Investments

Stay informed about your investment performance by tracking your portfolio through the TD Bank App. Here's how:

- Access Your Investment Portfolio: Within the app, navigate to the "Investments" section to view your portfolio.

- Monitor Performance: Review your investment performance with real-time data and analytics.

- Set Investment Alerts: Customize alerts for changes in your portfolio or market conditions to stay informed.

By actively tracking your investments, you can make informed decisions and adjust your strategy as needed to achieve your financial goals.

How Does the TD Bank App Compare to Other Banking Apps?

In the competitive landscape of mobile banking apps, the TD Bank App stands out for its user-friendly interface, comprehensive features, and robust security measures. However, it's essential to understand how it compares to other banking apps in the market to make an informed decision.

Key Differences

Here are some key differences between the TD Bank App and other banking apps:

- User Experience: The TD Bank App is designed with an intuitive interface that makes navigation easy for users of all ages.

- Security Features: With advanced security measures such as biometric authentication and two-factor authentication, the TD Bank App prioritizes user security.

- Comprehensive Services: Beyond basic banking services, the TD Bank App offers investment opportunities, budgeting tools, and business account management.

User Reviews and Ratings

User reviews and ratings provide valuable insights into the performance and reliability of the TD Bank App. Here's what users are saying:

- Positive Feedback: Many users praise the app's ease of use, efficient customer support, and comprehensive features.

- Areas for Improvement: Some users suggest enhancements in app speed and additional features for an even better experience.

Overall, the TD Bank App receives high ratings for its functionality and user satisfaction, making it a popular choice among mobile banking apps.

How to Troubleshoot Common Issues in the TD Bank App?

While the TD Bank App is designed to provide a seamless banking experience, users may occasionally encounter issues. Understanding how to troubleshoot common problems can help you resolve them quickly and efficiently.

Common Problems and Solutions

Here are some common issues users may face and their solutions:

- App Crashes: If the app crashes, try restarting your device or reinstalling the app to resolve the issue.

- Login Issues: Ensure you're entering the correct credentials, and if necessary, reset your password through the app.

- Slow Performance: Clear the app's cache or update to the latest version to improve performance.

Customer Support Options

If you're unable to resolve an issue on your own, TD Bank offers several customer support options:

- In-App Support: Use the in-app messaging feature to contact customer support directly.

- Phone Support: Call TD Bank's customer service hotline for immediate assistance.

- Online Resources: Visit TD Bank's website for FAQs and troubleshooting guides.

By utilizing these support options, you can receive timely assistance and resolve any issues you may encounter with the TD Bank App.

Benefits of Using the TD Bank App for Small Businesses

The TD Bank App is not only beneficial for individuals but also offers valuable features for small businesses. With its tailored solutions, the app provides small business owners with the tools they need to manage their finances efficiently.

Business Account Features

The TD Bank App offers several features specifically designed for small businesses, including:

- Multi-User Access: Grant access to multiple users, allowing team members to manage specific aspects of the business account.

- Expense Tracking: Track business expenses and categorize transactions for easier accounting and budgeting.

- Integrated Payment Solutions: Process payments and invoices directly through the app, streamlining cash flow management.

These features empower small business owners to manage their finances effectively, saving time and resources.

Integrating Business Tools

In addition to its business account features, the TD Bank App can be integrated with other business tools to further enhance productivity. Here's how:

- Third-Party Integrations: Connect the app with accounting software such as QuickBooks for seamless financial management.

- Customizable Reports: Generate customized financial reports to gain insights into business performance and make data-driven decisions.

By integrating these tools, small business owners can optimize their financial management processes and focus on growing their business.

Understanding the TD Bank App's Notification System

The TD Bank App offers a comprehensive notification system that keeps you informed about your account activity. By customizing alerts, you can stay updated on important changes and make informed decisions about your finances.

Customizing Alerts

Here's how you can customize alerts within the TD Bank App:

- Access the Alerts Section: Navigate to the "Alerts" menu within the app.

- Select Alert Types: Choose the types of alerts you wish to receive, such as transaction notifications or balance updates.

- Set Alert Preferences: Customize the frequency and delivery method of alerts to suit your preferences.

By tailoring alerts to your needs, you can ensure you're always in the loop about your account activity.

Staying Informed About Account Activity

The TD Bank App's notification system provides real-time updates on your account activity, allowing you to:

- Monitor Transactions: Receive instant notifications for transactions, helping you keep track of your spending.

- Stay Updated on Account Changes: Be alerted to any changes in your account status, such as deposit confirmations or overdraft warnings.

With these updates, you can stay vigilant about your financial activity and take necessary actions to protect your assets.

How to Utilize the TD Bank App for Budgeting?

The TD Bank App offers a range of budgeting tools that can help you manage your finances more effectively. By leveraging these tools, you can gain better control over your spending and work towards achieving your financial goals.

Budgeting Tools Available

Here's an overview of the budgeting tools offered by the TD Bank App:

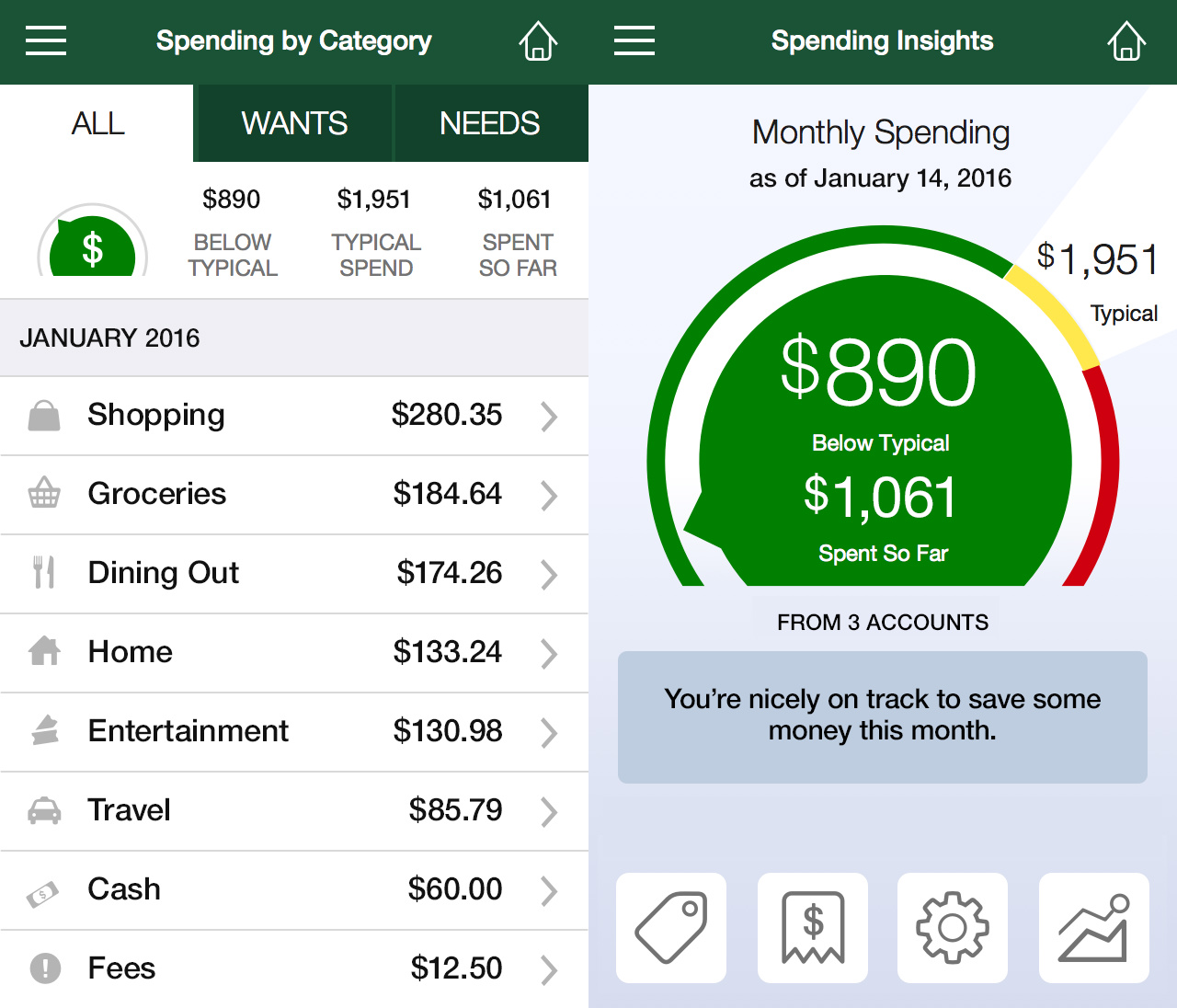

- Expense Tracking: Automatically categorize your transactions for easy analysis and budgeting.

- Budget Planner: Set up monthly budgets and track your progress toward achieving your financial goals.

- Spending Insights: Gain insights into your spending habits with visual reports and graphs.

Analyzing Spending Habits

By analyzing your spending habits, you can identify areas where you can cut costs and save money. Here's how:

- Review Transaction Reports: Access detailed reports of your transactions to understand your spending patterns.

- Identify Spending Trends: Look for trends in your spending habits and identify areas where you can make adjustments.

- Set Savings Goals: Use the app's budgeting tools to set realistic savings goals and track your progress.

By utilizing these insights, you can make informed decisions about your finances and work towards achieving your financial objectives.

FAQs About the TD Bank App

Here are some frequently asked questions about the TD Bank App and their answers:

Can I access the TD Bank App internationally?

Yes, you can access the TD Bank App internationally. However, some features may be limited based on your location.

How do I reset my TD Bank App password?

To reset your password, go to the login screen and select "Forgot Password." Follow the prompts to reset your password securely.

What should I do if the TD Bank App crashes?

If the app crashes, try restarting your device or reinstalling the app. If the issue persists, contact TD Bank customer support for assistance.

Are there any fees for using the TD Bank App?

No, the TD Bank App is free to download and use. However, standard data charges from your mobile carrier may apply.

How do I update the TD Bank App?

To update the app, visit the Google Play Store or Apple App Store and check for available updates. Download and install the latest version to ensure optimal performance.

Can I customize the TD Bank App interface?

While the app doesn't offer extensive customization options, you can personalize certain aspects, such as alerts and notifications, to suit your preferences.

Conclusion

The TD Bank App is a powerful tool that empowers users to manage their finances efficiently and conveniently. With its wide range of features, robust security measures, and user-friendly interface, the app caters to the diverse needs of both individuals and small businesses. By leveraging the capabilities of the TD Bank App, users can streamline their banking activities, explore investment opportunities, and make informed financial decisions. As technology continues to advance, the TD Bank App remains at the forefront of mobile banking, providing users with the tools they need to navigate the financial landscape with confidence.

For more information on the TD Bank App and its features, visit the official TD Bank website.