In today's digital age, managing personal finances has become increasingly reliant on secure and efficient online platforms. GTE Financial, a leading financial institution, offers members a seamless experience with its online banking services. Among the pivotal features of this system is the GTE Financial login, which provides users with access to a range of financial tools and services. Ensuring the security of your financial information is paramount, and GTE Financial takes this responsibility seriously by implementing robust security measures to protect your data.

For those who are new to GTE Financial, the login process might seem daunting at first. However, it is designed to be user-friendly and straightforward, allowing members to easily access their accounts from the comfort of their homes. With a few simple steps, users can log in to their accounts to view balances, transfer funds, pay bills, and much more. The convenience of having all these services at your fingertips is unparalleled, making it easier than ever to manage your finances efficiently.

Whether you're a new member or a seasoned user, understanding the nuances of the GTE Financial login process is crucial for maximizing the benefits of online banking. In this comprehensive guide, we will explore everything you need to know about accessing your GTE Financial account securely and effectively. From troubleshooting common issues to understanding the security protocols in place, this article will equip you with the knowledge needed to navigate the GTE Financial login with confidence.

Read also:Choosing The Perfect Raceline Wheels A Complete Guide For Every Driver

Table of Contents

- Overview of GTE Financial

- Why is GTE Financial Login Important?

- How Do You Create a GTE Financial Account?

- Step-by-Step Guide to GTE Financial Login

- Common Login Issues

- How to Recover a Forgotten Password?

- Security Measures in Place

- Benefits of Using GTE Financial Online Banking

- How to Ensure Your Login Security?

- Mobile Access to GTE Financial

- Financial Planning Tools Available

- Customer Support and Assistance

- Frequently Asked Questions

- Conclusion

Overview of GTE Financial

GTE Financial is a not-for-profit credit union that has been serving its members since 1935. With a mission to be a trusted financial partner, GTE Financial offers a wide range of services, including savings and checking accounts, loans, credit cards, and investment options. The institution is committed to providing exceptional service and competitive rates to its members, making it a popular choice for individuals seeking financial stability and growth.

As a member-owned cooperative, GTE Financial operates with the interests of its members at heart. This means that profits are returned to members in the form of lower loan rates, higher savings yields, and reduced fees. The organization prides itself on its community involvement and dedication to improving the financial well-being of its members.

Mission and Values

GTE Financial's mission is to empower its members to achieve their financial goals through innovative products, exceptional service, and a commitment to community development. The credit union values integrity, trust, and member satisfaction, striving to be a leader in the financial industry by consistently exceeding expectations and delivering superior value.

Why is GTE Financial Login Important?

Accessing your GTE Financial account online is a vital component of managing your finances effectively. The GTE Financial login provides a secure gateway to your account, allowing you to perform a variety of tasks with ease and convenience. Here are a few reasons why the login process is so important:

- Convenience: The ability to access your account 24/7 from any location means you can manage your finances on your terms.

- Efficiency: Online banking eliminates the need to visit a physical branch for routine transactions, saving you time and effort.

- Security: The secure login process protects your personal and financial information from unauthorized access, giving you peace of mind.

- Comprehensive Services: From checking account balances to transferring funds, the login portal offers a wide range of services to meet your needs.

How Do You Create a GTE Financial Account?

Creating a GTE Financial account is the first step towards accessing the multitude of services the credit union offers. Here's a step-by-step guide to help you set up your account:

- Visit the GTE Financial Website: Go to the official GTE Financial website to get started.

- Click on "Join GTE": Locate and click the "Join GTE" or "Open an Account" button on the homepage.

- Provide Your Information: Fill out the online application form with your personal information, including your name, address, and Social Security Number.

- Choose an Account Type: Select the type of account you wish to open, such as a savings or checking account.

- Verify Your Identity: Follow the instructions to verify your identity, which may include uploading identification documents.

- Submit Your Application: Review your information and submit your application for approval.

Once your application is approved, you will receive an email or notification with details on how to access your new GTE Financial account.

Read also:Polunsky Texas Insights Facts And Everything You Need To Know

Step-by-Step Guide to GTE Financial Login

Logging into your GTE Financial account is a simple process that can be completed in a few easy steps. Here's how:

- Visit the GTE Financial Website: Open your web browser and navigate to the official GTE Financial website.

- Locate the Login Section: Find the login area on the homepage, usually located at the top right corner.

- Enter Your Credentials: Input your username and password into the designated fields.

- Click "Login": After entering your details, click the "Login" button to access your account.

- Two-Factor Authentication: If enabled, you'll need to complete the two-factor authentication process for added security.

After successfully logging in, you'll have full access to your GTE Financial account and all the services available.

Common Login Issues

Occasionally, users may encounter issues when trying to log into their GTE Financial account. Here are some common problems and solutions:

Incorrect Username or Password

If you receive an error message indicating an incorrect username or password, double-check your credentials for any typos. Ensure that your Caps Lock is off, as passwords are case-sensitive. If you've forgotten your password, follow the password recovery process outlined later in this article.

Browser Compatibility

Ensure that your web browser is compatible with the GTE Financial website. Updating your browser or clearing your cache and cookies can often resolve login issues related to compatibility.

Account Lockout

After multiple failed login attempts, your account may be temporarily locked for security reasons. Contact GTE Financial's customer support to unlock your account and regain access.

How to Recover a Forgotten Password?

Forgetting your password can be frustrating, but recovering it is a straightforward process. Follow these steps to reset your password:

- Go to the Login Page: Navigate to the GTE Financial login page.

- Click "Forgot Password?": Locate and click the "Forgot Password?" link below the login fields.

- Enter Your Username: Provide your username or email associated with your account.

- Verify Your Identity: Follow the instructions to verify your identity, which may include answering security questions or receiving a verification code.

- Create a New Password: Once your identity is verified, create a new password for your account.

After successfully resetting your password, you can log in to your account using your new credentials.

Security Measures in Place

GTE Financial takes the security of its members' information very seriously. The institution employs several security measures to protect your data, including:

- Encryption: All data transmitted between your device and the GTE Financial servers is encrypted to prevent unauthorized access.

- Two-Factor Authentication: An additional layer of security that requires a second form of verification, such as a code sent to your phone.

- Regular Security Audits: GTE Financial conducts regular audits to identify and address any potential vulnerabilities in its systems.

- Fraud Monitoring: The institution monitors transactions for suspicious activity and alerts members of any potential threats.

Benefits of Using GTE Financial Online Banking

GTE Financial's online banking platform offers numerous benefits to its members, making it an attractive option for managing finances. Some of the key advantages include:

- Accessibility: Manage your accounts from anywhere, at any time, using a computer or mobile device.

- Comprehensive Account Management: View account balances, transaction history, and statements with ease.

- Bill Pay: Pay bills quickly and efficiently without the need for paper checks or envelopes.

- Fund Transfers: Transfer money between accounts or to other financial institutions with minimal hassle.

- Alerts and Notifications: Stay informed about account activity with customizable alerts and notifications.

How to Ensure Your Login Security?

While GTE Financial employs robust security measures, there are steps you can take to enhance your login security further:

- Use Strong Passwords: Create complex passwords that combine letters, numbers, and symbols to make them harder to guess.

- Enable Two-Factor Authentication: Opt for two-factor authentication to add an extra layer of security to your account.

- Monitor Your Accounts: Regularly review your account transactions for any unauthorized activity.

- Keep Software Updated: Ensure your devices and software are up-to-date to protect against security vulnerabilities.

- Avoid Public Wi-Fi: Refrain from accessing your account over unsecured public Wi-Fi networks to prevent data interception.

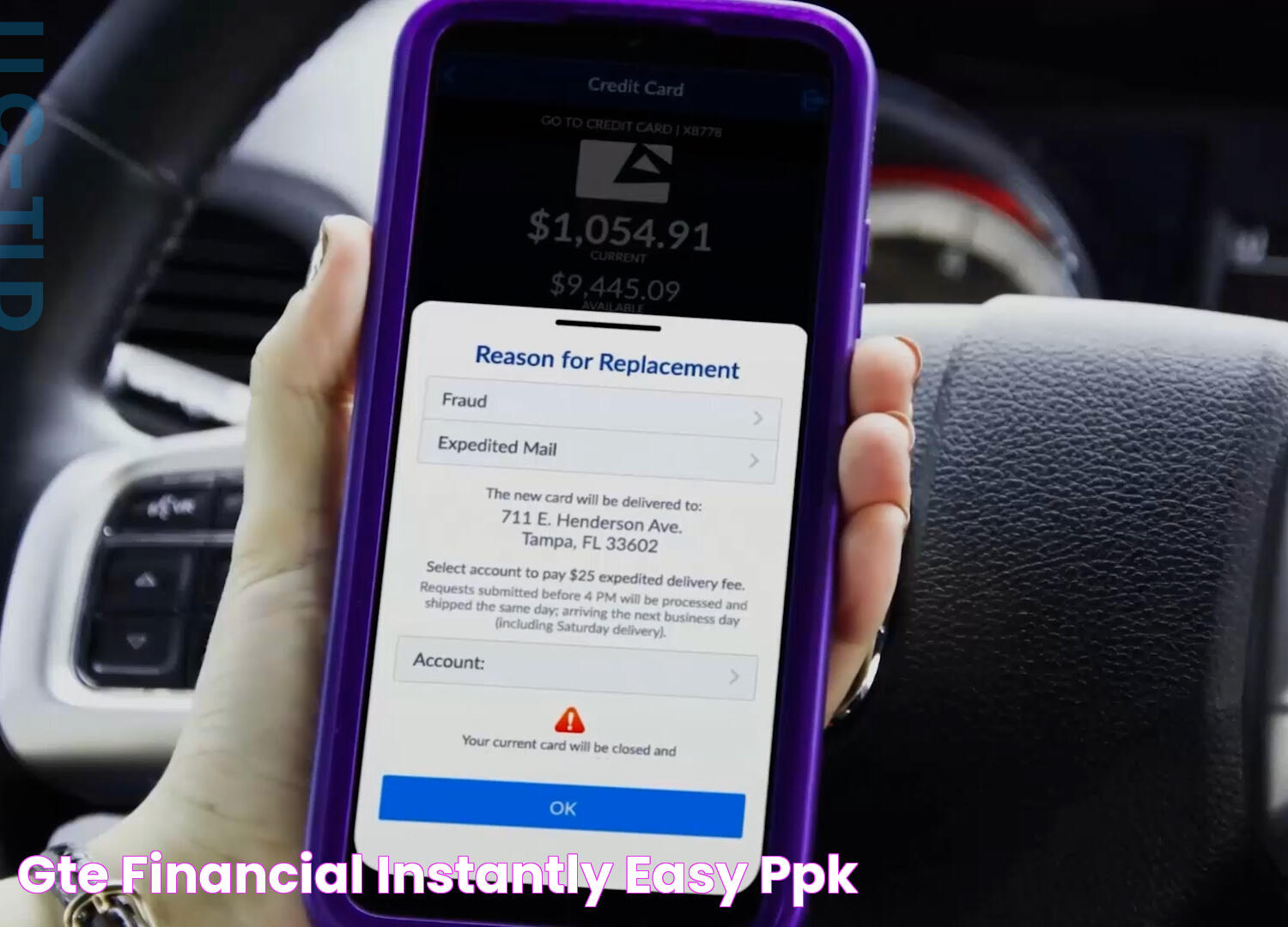

Mobile Access to GTE Financial

GTE Financial offers a mobile app that provides members with convenient access to their accounts from their smartphones or tablets. The app is available for both iOS and Android devices and includes features such as:

- Mobile Check Deposit: Deposit checks remotely by taking a photo with your mobile device.

- Quick Balance: View account balances without logging in for quick and easy access to your financial information.

- Bill Pay: Pay bills and manage payment schedules directly from the app.

- ATM Locator: Find nearby ATMs and branch locations with ease.

The mobile app is designed to provide a seamless and secure banking experience on the go, ensuring you have access to your finances whenever you need it.

Financial Planning Tools Available

GTE Financial provides a range of financial planning tools to help members achieve their financial goals. These tools include:

- Budgeting Tools: Create and track budgets to manage your spending and save effectively.

- Financial Calculators: Use calculators to plan for retirement, calculate loan payments, and more.

- Investment Resources: Access information and resources to help you make informed investment decisions.

- Educational Resources: Learn about personal finance topics through articles, webinars, and workshops.

These tools are designed to empower members to take control of their financial future and make informed decisions that align with their goals.

Customer Support and Assistance

GTE Financial is committed to providing exceptional customer support to its members. If you encounter any issues or have questions about your account, the following resources are available:

- Phone Support: Speak with a representative by calling the GTE Financial customer service line.

- Email Support: Send inquiries via email for prompt assistance from the support team.

- Online Chat: Use the online chat feature on the GTE Financial website for real-time support.

- Branch Visits: Visit a local branch for in-person assistance and support.

GTE Financial's friendly and knowledgeable staff are dedicated to helping members with any questions or concerns they may have.

Frequently Asked Questions

What should I do if I can't log into my GTE Financial account?

If you're unable to log in, double-check your username and password for accuracy. If the issue persists, contact GTE Financial customer support for assistance.

How can I change my GTE Financial account password?

To change your password, log into your account and navigate to the security settings section. Follow the prompts to update your password.

Is the GTE Financial mobile app secure?

Yes, the GTE Financial mobile app is designed with security in mind, using encryption and secure login protocols to protect your information.

Can I access my GTE Financial account from multiple devices?

Yes, you can access your account from multiple devices, including computers, smartphones, and tablets. Ensure each device is secure and protected.

How do I enable two-factor authentication for my account?

Log into your account and navigate to the security settings section. Follow the instructions to enable two-factor authentication for added security.

Does GTE Financial offer financial counseling services?

Yes, GTE Financial provides members with access to financial counseling services to help them achieve their financial goals and manage their finances effectively.

Conclusion

GTE Financial login serves as the gateway to a comprehensive suite of financial services designed to make managing your finances convenient and secure. By understanding the login process, utilizing the available tools, and following best practices for security, you can confidently manage your finances and achieve your financial goals. Whether you're accessing your account online or via the mobile app, GTE Financial provides the resources and support you need to succeed in your financial journey.